After You Hit Submit: The Hidden Complexity of Compliant Payments

Every year, $120 trillion in B2B payments flow between businesses globally. That number will hit $213 trillion by 2032. But here's the problem: for most payment processors, the moment you hit "submit,” your payment leaves your secure system and enters a maze of third-party processors, manual handoffs, and zero visibility. That's where risk explodes.

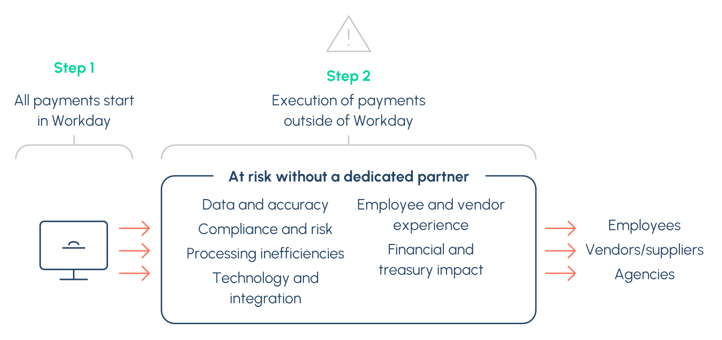

Effective payment systems operate within a single source of truth for financial data, approvals, and controls. But once transactions exit your tenant, you lose the control and transparency you expect. Fragmented payment vendors multiply your exposure — every additional system, file transfer, and manual step creates new opportunities for fraud, errors, and compliance failures. The payment risk is costing you more than you realize.

OneSource Virtual changes that. We handle employee payments, payroll tax filing, and vendor payments through one unified platform. Bank-grade fraud prevention protects over $220 billion annually. Real-time tracking gives you complete visibility. One trusted partner eliminates gaps and scales securely.

Download the infographic to see how a unified payment engine protects your business from fraud, delays, and hidden risk.

Get more finance insights

Case Study

.svg)